Major League Baseball franchise prices have only grown and grown, but the sport has never encountered a local media rights landscape like this. Likely at least one-third of the league’s 30 teams have taken a reduction in rights fees over the last two seasons, and by Opening Day, close to half the teams might be in that boat.

MLB is doubling the number of teams it will produce and distribute for broadcasts in 2025 to six, and more teams could be soon added. The league is taking on the role of a regional sports network out of necessity amidst cord-cutting and the long-running bankruptcy process of a major television partner, Diamond Sports Group. Another RSN partner, Warner Bros.-Discovery, exited the business in 2023, adding to the woes.

In the short term, local media rights will loom over baseball’s free agency. The offseason gets underway with the general managers meetings this week in San Antonio, Texas, and like last winter, some teams likely will modify their player spending plans to account for that revenue change. Teams rarely specify budgeting plans or rights-fees figures, however, so specifics are likely going to be hard to decipher publicly.

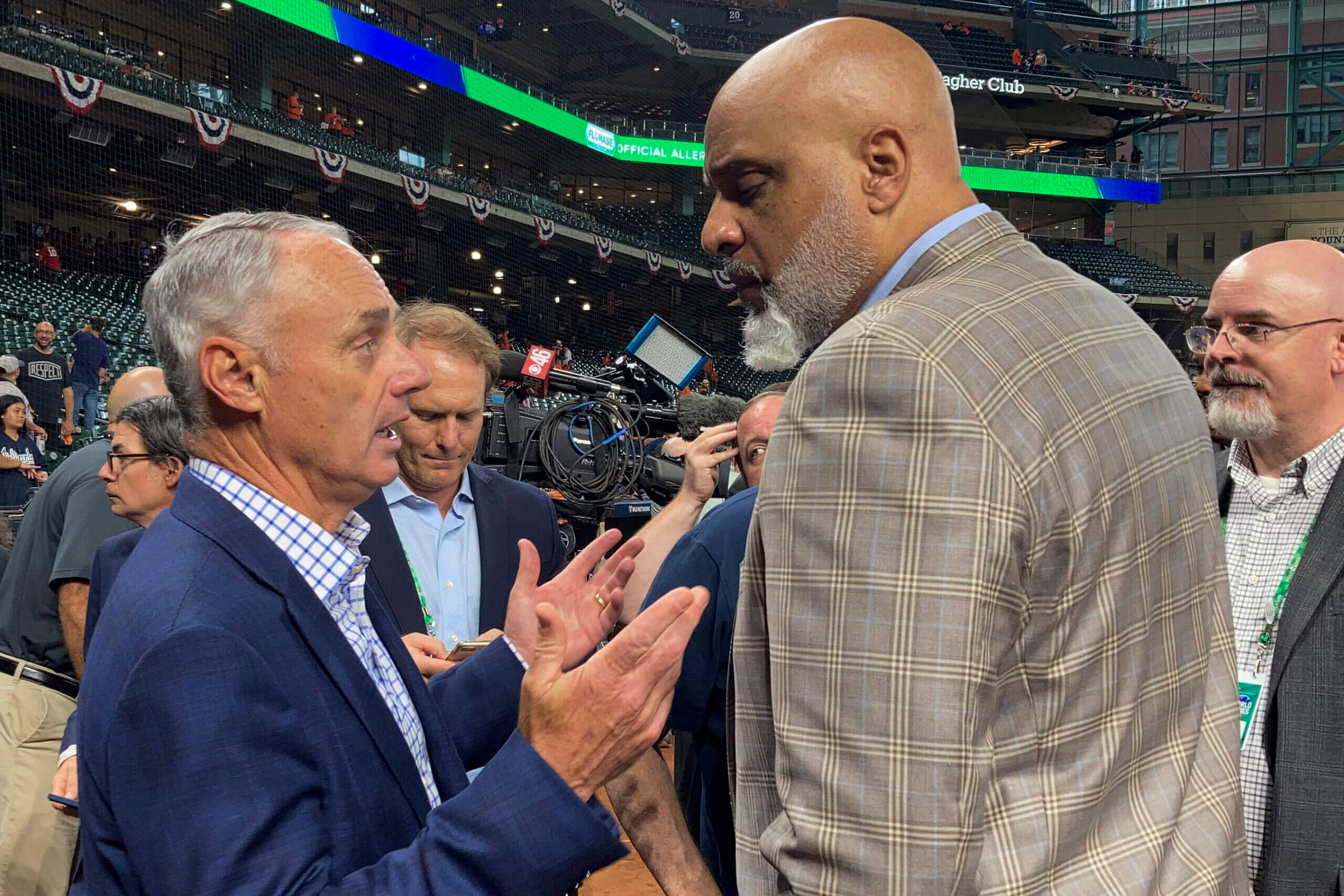

But the long-term outlook is a different discussion. During the playoffs, commissioner Rob Manfred and Players Association executive director Tony Clark both reiterated their belief that the struggle of some RSNs will not harm the overall value of franchises.

“My view is that people who are looking to invest in the game recognize the inherent value of our content and this is a blip, not something that’s going to fundamentally alter franchise values,” Manfred told The Athletic.

“No,” Clark said when asked if club worth is affected. “There’s only 30 of them.”

Given their positions, Manfred and Clark would rarely have incentive to be skeptical of franchise values, but a bellwether case is developing. The Minnesota Twins were publicly put up for sale last month, and they are the first club to hit the market with MLB’s central office as its broadcast partner.

They are also, for a second straight season, expecting to make less money from their TV rights than they did the year before. That creates an unprecedented circumstance: Since the rise of RSNs in the 1990s, no MLB team is known to have been sold with its TV rights fees in decline.

“We do expect there will be a reduction in local media revenue coming to the Twins in 2025. That’s a fact,” Twins president Dave St. Peter said last month. “That said, over the long haul, we have tremendous confidence in our content and believe that whereas maybe we’ll take a dip for ’25, over time, the viewership and those economics related to that viewership will increase.”

St. Peter said in court in 2023 that the team was paid about $60 million from Diamond that year, including the annual rights fee of $54 million, plus other related, ancillary money (such as the allocation of signing-bonus money from the deal). For 2024, the Twins then re-signed with Diamond for a lower figure.

Local media makes up a significant part of club revenue. The MLBPA this year told its members that local TV revenues range from 12 to 32 percent of a team’s total revenue, and that the majority of teams sit around an average of 21 percent.

“What someone’s going to pay for an asset is based on what they believe they can do with it long term,” said David Carter, an adjunct professor at USC Marshall’s School of Business who also runs a consultancy called Sports Business Group. “That’s where I think it’s really interesting: Someone might pay more or less for a franchise based on how they project the ability to monetize media rights going forward.”

The list of teams believed to have taken pay cuts includes six clubs whose telecasts will be run by MLB in 2025, rather than a typical third-party regional sports network: The Twins are joined by the Arizona Diamondbacks, Cleveland Guardians, Colorado Rockies, Milwaukee Brewers and San Diego Padres.

Other clubs believed to have already taken reductions include the Houston Astros, Miami Marlins, Pittsburgh Pirates, Seattle Mariners and Texas Rangers.

But more teams likely will soon be in the same boat. Diamond Sports Group operates the FanDuel-branded RSNs, which last year televised 12 MLB teams under a different name, Bally. No more than eight clubs will be with Diamond next season, and likely fewer.

A major hearing in Diamond’s bankruptcy proceeding is scheduled for Nov. 14. As part of that process, the Cincinnati Reds, Detroit Tigers, Kansas City Royals, Los Angeles Angels, St. Louis Cardinals and Tampa Bay Rays likely must soon choose between staying with Diamond on a renegotiated contract and reduced rights fee, or finding a new TV home — be it with MLB or elsewhere.

Yet, the consensus seems to be that the pain will be temporary.

A streaming solution?

In the last 10 years, professional teams across MLB, the NBA, NFL and NHL produced annual returns of 14 percent, according to an index co-launched this year by the private-equity group Arctos, which owns a piece of six MLB teams, and the Ross School of Business at the University of Michigan. For comparison, the index cites U.S. equities as growing 12.9 percent in the same period, through the second quarter of this year.

In a white paper it recently issued on sports investing, PGIM, which manages assets for Prudential Financial, said “sports teams offer the prospect of a recession-resilient growth asset that is broadly uncorrelated with stocks or bonds.”

“Sports is really going digital, and sports is emerging as ideal content, ideal IP, for an increasingly fragmented entertainment landscape,” Shehriyar Antia, the head of thematic research for PGIM, said in an interview. “MLB in particular offers a lot of content right near daily programming for a minimum of six months. And that kind of content is worth an awful lot to an Amazon Prime, to a Netflix, to a digital platform.”

(Both Arctos and PGIM have something at stake as investors in the space. PGIM invests in sports leagues and teams. Meanwhile, the Ross-Arctos Index was developed to burnish the idea that sports are its own asset class. Economist J.C. Bradbury of Kennesaw State University in Georgia said he was “somewhat skeptical of these types of analyses unless it’s been reviewed by other scholars.” The Ross-Arctos index has not undergone peer review.)

Eventually, MLB may be able to sell a national streaming package to a digital company, but the league doesn’t have access to enough teams’ rights to do so at the moment, and a lot of negotiation would be required to get there. A bundle of all 30 clubs would be most valuable to a streaming partner, but is difficult to develop in MLB’s current structure. The individual teams control their local media rights, not the league office.

The most valuable teams in the largest media markets largely seem to be escaping the turmoil. The one contract Diamond Sports Group is not attempting to renegotiate entering 2025 is with the Atlanta Braves, one of the sport’s most popular teams.

“In the near term you may have an impact. I think that the ship will right itself,” said Clay Miller, who is a lecturer at the Ross School of Business and an advisor to the Ross-Arctos Index. “If you were to try to invest or buy one today, you might be able to drive a bargain, because there is uncertainty, and anytime there’s uncertainty, there’s a discount. But I think long term it’s more about the value of the franchise than the regional sports network. I believe most of this will ultimately end up in the hands of streaming services.

“I think it’s not a baseball problem,” Miller continued. “It’s a Diamond Sports Group problem.”

The Twins aren’t being sold because of a dip in TV money, at least not solely. The Pohlad family can expect a huge windfall, and likely many different family members are interested in realizing it. Forbes valued the team this year at $1.5 billion, and any reasonable sale price will deliver a major profit off the $44 million the late Carl Pohlad purchased them for in 1984.

But, the local media situation might make cash flow less predictable for a prospective buyer. One of the appeals of partnering with a typical third-party RSN, rather than MLB, is the promise of a set fee per year, and a schedule of those fees for years to come. MLB’s arrangement is different.

“In this particular model, there is no rights fee,” St. Peter said. “There is no specific guarantee to the Twins. We’ve spent a tremendous amount of time with Major League Baseball trying to better understand this marketplace, trying to better understand what a model like this will ultimately provide to the team.”

What a club going with MLB can gain is in customer reach. Teams broadcast by the league are going to be watchable via a standalone subscription package, a streaming option fans can sign up for without needing cable or satellite. Some teams are available in a similar manner already, but the Twins, for example, were not.

Last year, MLB-produced teams were available for $19.99 a month, or $99.99 a year. Pricing for next season has not been announced.

The San Diego Padres, the first team MLB took over broadcasts for back in 2023, were nearing 40,000 streaming subscribers this summer, Manfred said in July. But, “from a revenue perspective, it is not generating what the RSNs did,” he said at the time. “The RSNs were a great business, lots of people paid for programming they didn’t necessarily want and it’s hard to replicate that kind of revenue.”

Murky territory

Even if the RSN situation does reduce the purchase price for a given team, the Twins or otherwise, it might be hard to detect in a final sale price. Prices could keep climbing at impressive clips for other reasons.

MLB, like other major sports leagues, allows private-equity groups to invest, a change in baseball only five years ago. Gerry Cardinale, who founded the private equity firm RedBird Capital Partners, said in September that the arrival of private equity into sports will need a soft landing “because right now it’s massively inflated.”

“This is about my crowd coming into sports. The problem with my crowd coming into sports is that they are asset managers,” Cardinale said at the IMG x RedBird Summit, per the Financial Times. “They just want to buy stuff, and that’s not great for intellectual property based businesses.”

RedBird owns the Italian soccer team AC Milan and also has stakes in Fenway Sports Group, the parent company of the Boston Red Sox and their TV station, NESN. It also is invested in YES, the New York Yankees’ TV network, and OneTeam Partners, a business arm of several sports unions.

And more private equity money could soon arrive in baseball.

“There is a lot of dry powder sitting on the sidelines,” Miller said.

A decrease year-over-year in one particular revenue stream opens up a pair of questions: Could growth in other areas cover that downturn, and how much do operating losses or profits matter for an asset that always appreciates in value?

“I’m sure teams would rather not go through this,” Bradbury said of the TV situation. “You always know that someone is going to be willing to pay you a billion dollars for that asset. So you’re not really cash-constrained by any stretch of the imagination. You’re focused on the long run.”

Arctos declined an interview for this story. In an interview with the outlet Pensions and Investments that was published in September, the group’s co-founder Ian Charles said “the leagues, especially the big leagues, have monopolistic pricing power with their media and data and sponsorship partners because increasingly it is the most important content.”

“The durability, the consistency and the predictability of the revenue streams is highly unusual and real asset-like,” he later answered.

—The Athletic‘s Dan Hayes contributed to this report

(Top photo: Stephen Maturen / Getty Images)